Hill Briefing on Rural Income Limit Fairness

Flawed income limit calculations prevent federal programs from reaching people they were designed to help.

On August 14, Fahe CEO Jim King, along with Woodlands Development & Lending Executive Director Dave Clark and Housing Development Alliance Executive Director Scott McReynolds traveled to the US Capitol to discuss rural housing and income limit fairness with Hill staffers, advocates, and administration officials. Attendees listened intently, took notes, and asked questions as our speakers described the issue and how it affects our communities.

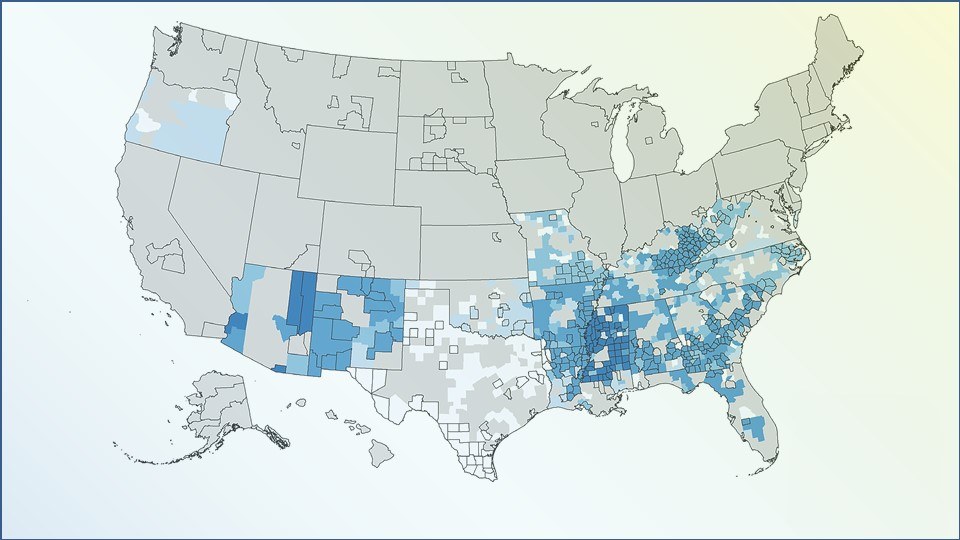

Despite Congress’s best intentions, low-income communities in states with high concentrations of rural poverty are doubly disadvantaged by the current system, which compares people to their neighbors to determine who is “low-income.” This system, based on an area’s median family income, leaves out many families who earn too little to afford stable housing, but too much to qualify for assistance, because their neighbors’ low earnings bring down the community’s (or state’s) median income. However, allowing families to qualify based on the national non-metropolitan median income would fix this problem and allow programs to reach people they were intended to reach.

Thank you to the organizations who support Fahe’s national floor proposal: cdcb| come dream. come build., Coalition for Home Repair, Communities Unlimited, Inc., Hope Policy Institute, National NeighborWorks Association, Habitat for Humanity International, National Rural Housing Coalition, Opportunity Finance Network, Oweesta Corporation, Partners for Rural Transformation, and Rural Community Assistance Corporation. If you’d like to learn more, find Fahe’s research on income eligibility limits here: https://fahe.org/income-eligibility-limits/

A map of the nearly 1,000 counties that have artificially low income limits because concentrated rural poverty overwhelms the system.

(L to R): Joshua Stewart, Fahe; Scott McReynolds, Housing Development Alliance; Dave Clark, Woodlands Development & Lending; Jim King, Fahe.

Scott McReynolds, Housing Development Alliance, and Dave Clark, Woodlands Development & Lending.