VCHR Housing Needs Assessment in Central Appalachia

The following post was prepared by Fahe’s Research Director, Katy Stigers. She provides a brief overview of the recently conducted study performed by the Virginia Center for Housing Research (VCHR) at Virginia Tech entitled “Housing Needs and Trends in Central Appalachia and Appalachian Alabama.” Ms. Stigers discusses portions of the study including the differences in sources of cost burden between urban and rural places within the Fahe service area as well as Fahe programs designed to alleviate these burdens such as our energy efficiency programs and ability to provide affordable financing to people and families.

The VCHR study can be read here: Housing Needs and Trends in Central Appalachia and Appalachian Alabama

Mel Jones, Associate Director and Research Scientist at VCHR, and Jim King, President and CEO of Fahe, recently hosted the Appalachia Housing Needs Assessment webinar which provided an overall review of the study can be viewed here: Appalachia Housing Needs Assessment Webinar

Fahe commissioned this rigorous study by the researchers at the Virginia Center for Housing Research at Virginia Tech in order to ensure that our region has the information it needs to assess current and future housing demand. The results are relevant to policymakers as well as housing developers and community development practitioners.

Prepared by Mel Jones, research scientist, and Samuel Spencer, research associate, the report analyses the results of custom tabulations of census data carefully compiled to evaluate the stock, demand, and affordability of housing in Central Appalachia and Appalachian Alabama (CA) —the Fahe service area.

The study’s findings draw on data collected by the American Community Survey (ACS), Comprehensive Housing Affordability Strategy Data (CHAS), and Public Use Microdata Samples (PUMS). The resulting county-level estimates utilize the most recent data available at the time of the analysis. The study also considers the Metropolitan Statistical Areas within the Central Appalachian Region, because those areas closely approximate housing markets. This is important because the combination of these sources of data represent one of the most granular perspectives on the quality of the housing stock in the region, the cost of living in the available housing, and the unmet needs in both rural and urban areas of the Fahe footprint.

Urban Vs. Rural Populations in Fahe Service Area

Some 9.7 million people, represented by 3.8 million households live in CA and Appalachian Alabama. A typical image of Appalachia is as a rural place, and that is certainly a defining characteristic of many areas in the region. However, Appalachia is also home to several significant metropolitan areas including northern Alabama, particularly around Huntsville, the Chattanooga and Knoxville, TN metropolitan areas, and the college towns of Blacksburg, VA, Lexington, VA, and Morgantown, WV. The employment and housing markets in urbanized Appalachia are different from those same markets in rural areas, which in turn influence the housing stock available in these two different environments of the Fahe service area.

For example, the metropolitan (urban) and rural proportions of households in the Tennessee counties of CA are 67% and 33% respectively, while in neighboring Virginia the numbers are almost the inverse. Only 35% of people in the CA counties of Virginia live in metropolitan areas while 65% are in rural areas. In terms of population there are almost three times as many households in CA Tennessee as in CA Virginia. These urban and rural characteristics are important conditions under which the housing markets are operating. (See infographic)

Information on characteristics of households in CA are reported by the ACS for 1-, 2-, 3- and 4-or-more person households. As policy makers consider the needs for different kinds of housing in their areas the types of householders is important. For example, according to the VCHR study, “one-person households are most prominent in urban areas with high populations of single professionals.” In places where the number of 1-person households are outliers, such as Radford, VA where a university is a prominent anchor institution there is a high demand for rental housing, and these are the areas with the lowest rates of homeownership. Other places with relatively lower rates of homeownership are those localities which provide some of the rare multi-family rental housing in the region.

Places with relatively high proportions of 2-person households, like Lexington, VA or Martin County, KY may point to places where retirees or empty-nesters have clustered because smaller houses or attached dwellings might be more attractive. Hotbeds of college students or empty-nesters result types of housing targeted for particular life-stages that leaves these areas as outliers in the data. Unfortunately, in other communities in the region, there are mismatches between the housing demanded by housings and the market’s supply and price-point, especially for low-income families.

Cost-burden is defined as spending 30% or more of income on housing. Due to the rules governing mortgage underwriting it is virtually impossible for a homeowner to obtain financing for a house that exceeds that 30%. This isn’t to say that homeowners are not ever cost-burned, only that households usually don’t begin homeownership with a burdensome payment. Consequently, it is unsurprising that it is renters who are disproportionately cost-burdened. This is illustrated in the accompanying infographic. Despite representing only 30% of households in CA, nearly half of all cost-burdened households are renters. A lack of supply of affordable housing in the rental market in rural areas and high demand and costs in metropolitan ones combine to increase the financial pressure on the households at the lower end of the income ladder.

The

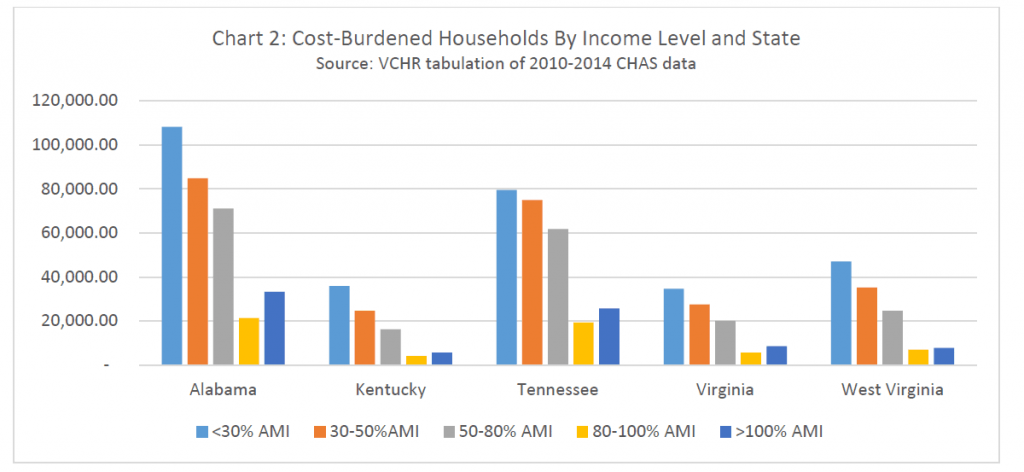

chart below, which comes from the study, illustrates how cost burden is most

common among those at the lowest income bands, and is a very small proportion

of those whose incomes are at or above 100% of their Area Median Income.

The second chart (also from the study) also shows cost-burden by state according to income levels, but represents the number of households rather than the percentage of households cost burdened in each state. Alabama, where the Appalachian counties are largely metropolitan, has the highest number of cost burdened low-income households. According to VCHR study, Tennessee and Alabama, “with more metro areas and higher population density, have more than 60 percent of the region’s cost-burdened households”.

Overall the proportion of homeownership in CA is high in both the rural and urban areas of the region. The study authors also note, “Tenure has implications for housing affordability. Renters are more susceptible to increasing costs of housing and disproportionately cost-burdened…While households renting represent only around 30 percent of all households, they represent nearly half of all cost-burdened households. In all but four counties, households renting are disproportionately cost burdened.” (VCHR)

Impact of the Fahe Network

There are many important findings in the full report, however the remainder of this post will highlight two observations that tie directly to the work Members sustain through their efforts on the ground.

The first is that among homeowners one important source of their cost burden stems from costs of ownership, rather than mortgage. However, this isn’t clearly reflected in the available data. The burden stems from the costs of home maintenance that accrue over time in aging homes. While homeowners may begin their tenure in a house with an affordable mortgage, changes in income, increasing expenses in other areas (such as healthcare or transportation) can decrease the funds available to update a house.

The type of housing most prevalent throughout CA is detached single-family homes. In rural or micropolitan counties the second most common housing type is a mobile or manufactured home, while in urban areas multi-family units are the next common type of dwelling. The most common type of energy powering homes is electricity, followed by gas from a utility, with gas tanks rounding out the top three (and representing over 90% of fuel usage). Median utility costs as a percentage of median housing costs for homeowners can be very significant, which is a sad irony in a region that produces significant amounts of fuel for the nation’s energy needs, first through coal and now through fracking. The cost of utilities alone result in 248,715 households managing housing cost burdens.

A second challenge facing the region is the age and quality of its housing stock. The quality of construction of homes built in the 1970s, 80s, and 90s is not as good as houses built in the 1940s or 1950s. Due to historic development patterns, many of those homes are also located in proximity to amenities, and are even in walkable areas, reducing auto-dependence. Homes in the 1960s may also be in good condition, albeit in areas where cars become a necessity. These older homes have also been in the market long enough to have had repairs and upgrades. But houses built more recently, especially in the 1970s and 1980s are typically located in “sprawling” suburban development, are at or nearing the time for significant system replacement, and are in areas that require substantial spending on transportation. Housing built in the 1970s, 80s, and 90s represents nearly 50% of the housing stock in CA.

Two challenges – energy cost and housing stock – are addressed by Fahe. With support from the Appalachian Regional Commission the Appalachia Heat Squad has developed a platform to support families already strapped by expensive energy bills. Through energy audits and a repair and rehabilitation program, financed by low-interest products available through Fahe’s mortgage division, JustChoice Lending , homeowners can determine the sources of their energy inefficiencies and lower their monthly utility costs through a combination of simple maintenance and more extensive upgrades. The Appalachia Heat Squad’s energy and home repair program also mitigates the negative health impacts of living in an improperly insulated, energy inefficient house. By reducing the risk of mold, temperature extremes, and loss of warm or cool air, homeowners can avoid respiratory problems or other threats to their health and safety.

Through the extensive efforts of Members to build and the partnership of Fahe to bring finance to the region, some of the housing need is being met. However, expanding programs like the Appalachia Heat Squad and planning for the future needs of Appalachians is also urgent and important. It is particularly important that housing be targeted for people who fall below 80% of area median income and that finance and support exist to support those families whose homes are on the cusp of needing significant costly repair or renovation.

Fahe commissioned the study from VCHR to further strengthen our strategies on how best to serve Appalachia. By being tied into the communities we serve through our Members and careful consideration of the real need, we are able to make long lasting impact in the communities we serve.