Fahe’s 40th Anniversary: Progress Through the 2000s

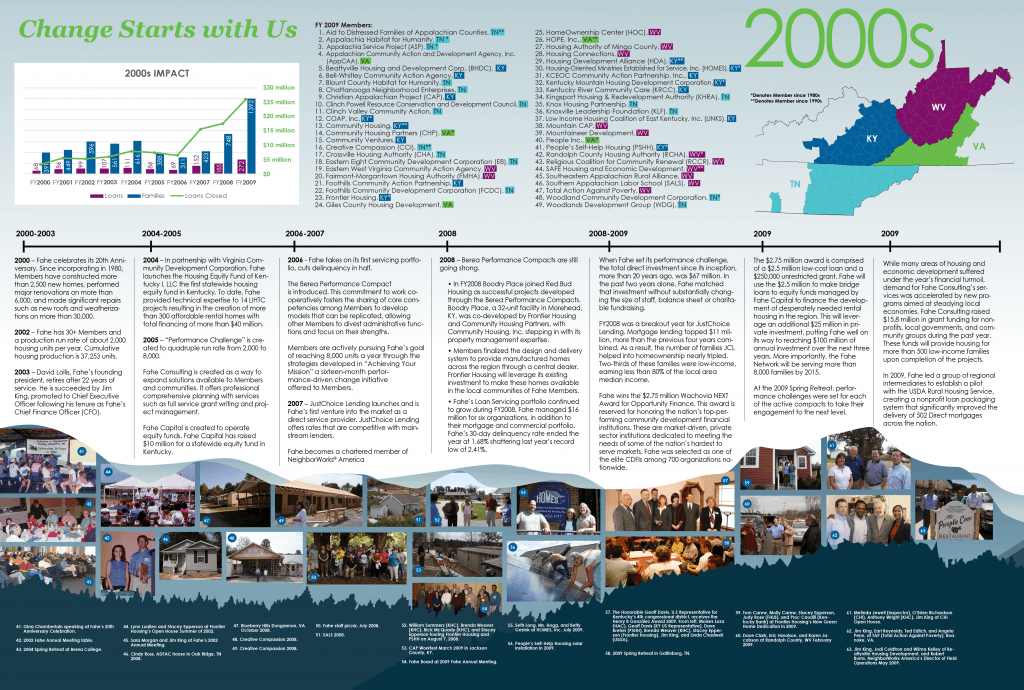

The early 2000’s brought a transition in leadership form David Lollis to Jim King. It also marked a time of dynamic change for Fahe. Over the past twenty years, Fahe had grown to over 30 Members, reached over $23.2 Million in total assets, managed a loan portfolio of $17.5 Million, and the Membership had a production run rate of nearly 2,000 housing units per year, with a cumulative production of 37,253 units.

However, it was identified Fahe was also facing several major issues which could threaten the organization’s long-term viability. Some of the issues included the company’s self-sufficiency, which at the time was about 38%. Fahe’s lending portfolio was not strong at the time. Delinquency rates were at 15% for loans other organizations wouldn’t accept. And Fahe didn’t have products in place for stronger customers and had to refer them to other organizations for financial products. Finally, it was noted that Fahe was falling behind in the value it could offer to higher performing Members.

Several solutions were put into motion. In 2003, Fahe developed a new strategic plan with the help of Opportunity Finance Network that centered on Fahe’s advocacy and the strength of the membership network. Five strategic goals were created: 1. Redefine technical assistance to better meet Member needs, 2. Expand capital base to ensure adequate access to capital and programs for Members, 3. Promote self-sufficiency through product development and increased efficiency, 4. Examine and revise governance structure to promote membership participation, and 5. Develop a proactive advocacy agenda to expand support for Fahe and Member programs in Central Appalachia.

In 2004, in order to address the great need but low solutions to housing in the area, Fahe issued a 10 year performance challenge to the Membership to reach a production run rate of 8,000 units of housing per year. The goal of 8,000 units was broken one year early for a totally of 8,725 households served in 2014.

The Berea Performance Compact was introduced in 2006 as a way to foster the sharing of core competencies among Members to develop models that can be replicated, which allows for other Members to focus on their strengths.

2007 saw the launch of Fahe mortgage division, JustChoice Lending as well as Fahe joining the ranks of the NeighborWorks America membership.

In 2008, JustChoice Lending provided more than $11 Million in mortgages, which is more than the previous four years combined.

By 2009, the Fahe Network had already more than doubled housing production to 4,300 units per year and deployed $41 Million in capital.

While the early 2000s were a time of great transition and difficult change both for the Fahe and the Network, it helped to reinforce a performance-oriented culture focused on stability, expertise, and innovation. The amount of growth, scale, and sustainability achieved would go on to set the stage for even bigger and greater achievements for Fahe and the Appalachian region.