A Once-in-a-Generation Opportunity

How Strengthening Capital Flows to our Underserved Communities Can Help Every Family Reach their American Dream

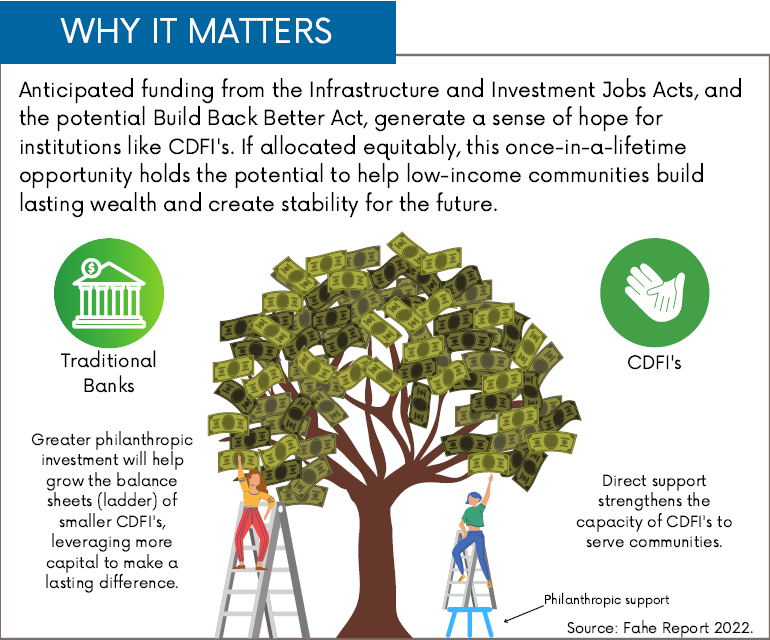

With the recent passage of the Infrastructure Investment and Jobs Act on November 15, 2021, communities across the country have the opportunity to access a once-in-a-generation influx of transformational public investment. Community Development Financial Institutions (CDFIs), like Fahe, that are able to harness these funds can be better positioned to support the initiatives of local leaders to uplift their communities and create lasting economic opportunity for decades to come.

Fahe and our community development colleagues in the Partners for Rural Transformation (PRT) have already begun to assemble plans for transforming this anticipated funding into tangible impact in our communities. Fahe’s close connectivity with our on-the-ground leaders across six Appalachian states through our unique Network model gives us an intimate perspective of local needs and helps us connect underserved rural communities with the expertise and resources to find, apply for, and administer such funding.

However, existing programs and scoring criteria are designed to support capital flow into communities with already-established channels for deploying resources in their markets, which are typically urban and enjoy high population densities and diverse banking communities. The established wealth within these areas makes it easier for them to identify, secure, and operationalize funding opportunities from finite pools of investment dollars. By comparison, historically underserved regions, such as Appalachia, often struggle to compete against applications representing more functional markets with access to locally-sourced matching funds. As a result, the families and communities living in these underserved areas receive far less capital support from government agencies and programs, which keeps “new” resources from reaching those who need it most. This institutional preference for developed, well-capitalized urban markets perpetuates a cycle of exclusion for overlooked, chronically underserved areas. Predictably, Persistent Poverty Areas (PPAs) like Appalachia and the Deep South rarely see the robust volume of investment dollars they need to effectuate local interventions and economic turnaround projects.

However, government programs and agencies are not alone in sliding down the path of least resistance when it comes to deploying development dollars. Because of the relative ease in replicating and scaling projects, philanthropic investors tend to gravitate towards well-developed urban markets that allow them to create a volume of impact far exceeding the numerical reach of more isolated rural areas. In fact, from 2010-2014, philanthropic grant-making in Appalachia, the Mississippi Delta and the Rio Grande Valley was only around $43 per person – well behind the national average of $451, and dramatically less than the $4,096 per person invested in high-wealth areas like San Francisco. For the approximately 21 million people who call persistent poverty areas home, however, this disparity only serves to exacerbate the challenges that already encumber their journey towards achieving the American Dream.

If Fahe and our CDFI peers serving PPAs across the nation are to be successful in directing this transformative funding to overlooked people and places, then we need our philanthropic partners to prioritize place-based CDFI’s in PPAs in order to build capacity and coordinate the development of locally-guided, enduring regional solutions. These timely investments can act as a force-multiplier for local leaders, ensuring regional actors like Fahe can adequately support our Networks of on-the-ground experts with advocacy, coordination, financing, and strategic planning to maximize impact and forge public-private partnerships to leverage transformational community outcomes. Over the long term, these collaborative interventions can foster an established climate of routine cooperation among commercial, non-profit, and public-sector stakeholders, allowing Fahe to develop and convey its trusted partnerships with policymakers and agency leaders throughout our local Networks. As a result, systemic shifts in public policy and applied community development practices can improve the design of established programs, reversing the current trends that perpetuate inequity by bypassing underbanked rural localities in favor of fully functional, more affluent markets. This combination of short and long-term approaches is key to our vision for creating greater equity and will help build thriving communities where every family can reach their American Dream, no matter where they live.

Existing Public Policy is Built on a History of Good Intentions Gone Unrealized

The 1977 Community Reinvestment Act (CRA) is a critical tool throughout much of the country to ensure banks lend, invest, and provide services to low-income neighborhoods. Created to encourage financial institutions to meet the credit needs of the communities where they do business, including for low and moderate-income residents, CRA has served as a valuable instrument to combat discriminatory banking practices and helped open credit opportunities for communities that many commercial lenders may have otherwise deemed “too risky.”

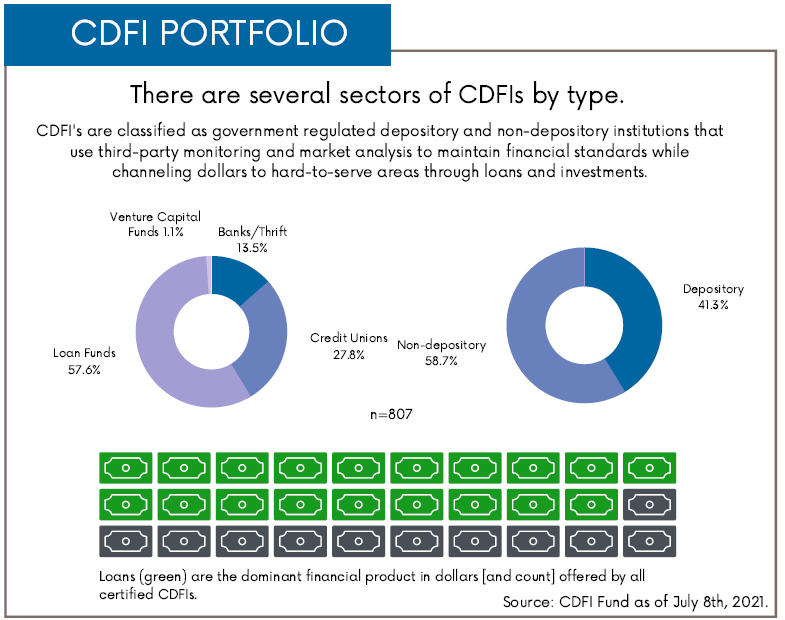

However, despite the best intentions of those who crafted it, the Community Reinvestment Act suffers from its own design flaws. Due to the low concentration of depository institutions like banks, credit unions, and some CDFIs located within the borders of underserved PPAs, the law tends to favor areas with higher levels of investment and abundant banking options. Because these PPAs are largely underbanked, the majority of CRA-enabled funds inevitably end up flowing to metropolitan areas in the absence of any meaningful incentive to draw them into underserved markets. As a result, a prospective borrower’s geography, as well as income, still has an oversized impact on his or her access to capital and lending opportunities, leading to further ostracization of rural communities from financial systems.

Another example of a well-intended program that has fallen short of its full potential is the Emergency Capital Investment Program (ECIP). Announced in Spring of 2021 by the US Department of the Treasury, ECIP is designed to invest $9 Billion into Minority Depository Institutions (MDIs) and depository CDFIs to support financial products for small and minority-owned businesses and consumers in low-income and underserved communities. While this $9 billion injection represents a positive step towards greater equity and investment for areas of our nation that are too often neglected, the program still fails to fully bridge credit access gaps by excluding non-depository CDFIs like Fahe and our PRT partner Oweesta Corporation, which bear the CDFI designation of a Community Development Loan Fund.

ECIP programs focus on depository institutions, which some view as a safer option over non-depository institutions. However, Fahe and other Community Development Loan Funds are held to rigorous accountability and quality control mechanisms to guarantee the sustained value of our investors’ dollars. We perform regular report-outs, accommodate investor needs, and utilize third party certification services such as AERIS to provide validation and peace of mind, similar to traditional bank FDIC ratings. Despite the fact that Fahe and our PRT allies have a 100% repayment history, some investors can vastly overestimate our risk profile. In fact, the flexibility afforded by our designation as Community Development Loan Funds makes Fahe one of the safest and most impactful investment vehicles available in the markets we serve.

Non-depository CDFI’s like Fahe also enjoy more flexibility to design and offer customized, innovative lending products that can tap into markets where traditional commercial lenders lack the local relationships and insights to confidently serve. Because of this flexibility, non-depository CDFIs such as Redbud Lending (launched by a Fahe Member and supported by an inaugural investment from Fahe’s Community Loan Fund) are assisting low-income families who have fallen prey to the payday lending industry by helping them reposition their personal finances to more closely resemble those of higher-credit borrowers. Because Fahe and our PRT peers are located in the places that we serve, we have both the perspective and flexibility to underwrite projects and borrowers differently, without incurring greater risk. While federally-insured depository institutions may perceive too many obstacles to profitably reach these markets, CDFIs like Fahe are able to provide equitable lending opportunities to all people.

Ensuring CDFI’s can fulfill their mission to close capital gaps in underserved and underbanked communities will require philanthropists and government agencies to fully back all types of CDFIs, depository and non-depository alike. Without a change to program design, CRA and many other well-intended federal programs will continue to fall short of creating the stability and impact they are meant to achieve, and as a result, communities and families in underserved places will fall even further behind.

Philanthropy Must Act Quickly to Provide Access to this Opportunity

While many of the obstacles facing low-wealth communities and people of color existed long before the emergence of COVID, the ongoing pandemic has disproportionately impacted those who are least resilient to its financial afflictions on household budgets and introduced an urgency for economic intervention. The funding coming from the Infrastructure Investment and Jobs Act combined with increased public interest in underinvested communities offers a rare opportunity to help our forgotten neighbors build durable wealth and stability for the future. Fahe’s deep-reaching platform and highly-localized Networks could be harnessed to significantly increase the flow economic rescue funds and other life-changing investments into underserved households and communities.

However, to do so, Fahe and other CDFIs need financial backing from philanthropic organizations to grow our capacity in staff resources, in-house expertise, administrative support, and similar functions in order to nimbly capture public investment and grant opportunities when they emerge. Moreover, increasing our cash reserves can strengthen our competitive posture for federal project and program dollars by offering the requisite matching funds needed to qualify for such investments.

Fahe and our CDFI allies across the nation have been diligently working to provide direct support and boots-on-the-ground relief to our partners during the pandemic so that they could focus on what they do best—serving their communities. Rising up to meet the rare opportunities of this historic moment will now require evolving our operations into specialty services that many community-based organizations simply do not have the bandwidth or expertise to fully deploy, such as grant-writing, strategic project development, fiscal oversight, compliance, and other technical obligations needed to secure and administer public funding. Moreover, to guarantee a seat at the policymaking table for the communities that have traditionally been excluded from it, CDFIs and our partner advocates will also seek to bolster government engagement with the officials and agencies responsible for appropriating and dispersing much of the funding.

For mission-minded foundations, investors, and other agents of change, the enactment of the Infrastructure Investment and Jobs Act presents an exceptional opportunity to equip our forgotten communities and the organizations that serve them with the tools and resources to finally channel public investment to the people and places where it can have the greatest impact. If you’re unsure where to start, reach out to Fahe or any member of the Partners for Rural Transformation.